This glossary is for Medicare agents and Medicare beneficiaries who want to understand the jargon being tossed around by people in the Medicare system: government bodies, government employees, insurance companies, online-call-and-enrollment centers, advocacy groups, insurance agents, and advisers. The glossary is intended to give you enough information that you can search online and know if you are looking at useful literature.

- Abuse (Part of Fraud, Waste & Abuse)

- Abuse includes actions that may, directly or indirectly, result in unnecessary costs to the Medicare Program. Abuse involves payment for items or services when there is not legal entitlement to that payment and the provider has not knowingly and or/intentionally misrepresented facts to obtain payment.

- ACO

- Accountable Care Organizations—The purposes of ACO’s are to lower growth in health care costs while meeting and maintaining performance standards regarding the quality of care. ACO’s are an organized response to the unmanageable inflation of the fee-for-service (FFS) business model. ACO models, like the Medicare Shared Savings Program (MSSP), target population health and try to coordinate care to better control Medicare costs, beneficiaries, and providers. Entities that may create or participate in ACO’s include (1) physicians, physician assistants, nurse practitioners or clinical nurse specialists operating in group-practice arrangements; (2) networks of individual practices of ACO professionals; (3) partnerships or joint venture arrangements between hospitals and other ACO professionals; (4) hospitals employing ACO professionals; and, (5) other Medicare providers and suppliers as determined by the Secretary of Health and Human Services (HHS). Eligibility for ACO status demands that organizations must serve at least 5,000 Medicare beneficiaries. ACO activities include documenting evidence supporting their decisions, engaging with beneficiaries on health topics, collecting 33 types of quality and cost metrics (a type of managerial accounting within a health domain). The measurements strive for continuous improvement. Organizations that follow these changes from fee-for-service practice can coordinate care among primary-care physicians, specialists, acute-care providers, and post-acute-care therapists.

- Acute Care

- Acute care is a branch of health care where a patient receives active but short-term treatment for a severe injury or episode of illness, an urgent medical condition, or during recovery from surgery. In medical terms, care for acute health conditions is the opposite from chronic care, long-term care, and short-term care.

- AEP

- See Election Periods.

- AHIP

- America’s Health Insurance Plans—a national trade association (lobby or special-interest group) with 1300 carriers as members. AHIP sponsors and/or provides many educational programs and training to the health insurance industry as a whole. There are specific industry accreditations available through AHIP educational systems. Annually, AHIP prepares CMS approved electronic educational content along with the accompanying testing and certification regarding the laws and regulations affecting Medicare sponsors and their downstream entities (like insurance agents). The test and certification is also known by carriers has AHIP certification. Most carriers will accept or require a passing AHIP exam as part of the CMS mandated annual training for certification. Sometimes a carrier will write training modules equivalent to the AHIP modules (UnitedHealthcare) or sometimes a carrier will work with Gorman Sales Sentinel (see Gorman) to provide training. Recently (in 2015), UnitedHealthcare, the largest health insurer, withdrew its membership and support.

- Ancillary or additional health plans

- This is the set of health related plans that are not managed by CMS as part of the government regulated plans nor are they considered to be core health plans or creditable prescription drug coverage. Examples of ancillary plans are: Hospital Indemnity Plans, Cancer Plans, Dental Plans, Dental-Vision-Hearing Plans, and so on.

- ANOC

- Annual Notice Of Change—Since plans may change every year, carriers are required to send an explanation of the changes that will be implemented in the plan for the coming year when applicable. These notices are usually sent out around October for the following calendar year. If the plan is terminating, the ANOC can also serve as an SEP notification.

- APM

- Alternative Payment Models—According to the Medicare Access and CHIP Reauthorization ACT of 2015 (MACRA), physicians and other providers who repudiate the fee-for-service (FFS) business model and wish to serve Medicare and other government beneficiaries must use certified electronic health records technology and adhere to quality measures comparable to those used under the Merit-based Incentive Payment System (MIPS). In addition, they must assume at least some financial risk by participating in programs such as those being tested by the CMS Innovation Center, an Accountable Care Organization (ACO) under the Medicare Shared Savings Program (MSSP), episodic bundled payments offered through the Bundled Payment for Care Innovation (BPCI) program, a demonstration through the Health Care Quality Demonstration Program or another demonstration program authorized through Federal law. Such programs are expected to continue to evolve for decades until health costs become more manageable for citizens and government.

- Appointment

- Agents and agencies must be appointed by a carrier to sell its insurance products after they have been duly licensed by the state. An official appointment includes the carrier’s reporting to the state that a particular agents is authorized to represent their plans. For PDP, MA or MAPD products, retaining an appointment includes an annual certification process. It must be complete to be able to sell the new year’s plans during AEP and to retain residual commission payments.

- Base Beneficiary Premium

- The base beneficiary premium is used to calculate the Late Enrollment Penalty for Part D. The premium and penalty are calculated by CMS around June every year from the bid amounts from the Part-D insurance carriers for the following year. The base beneficiary premium is lower than the average national premium by a fudge factor that CMS calls the beneficiary premium percentage. CMS comes out with a document each year explaining to one degree or another how the numbers were calculated from the national average monthly bid amount. As an agent, you need to know that CMS lowers the penalty through this calculation.

- Benefit Period (Original Medicare)

- A Medicare benefit period names the period of time pertaining to an inpatient stay, either in a hospital or skill-nursing facility. A benefit period begins upon admittance to an in-patient facility and ends when the patient has not received in-patient care for 60 days in a row.

- BRC

- Business Reply Card—These are pieces of a direct-mail piece that are pre-addressed and pre-stamped so that recipients of direct mail can easily respond. They are important in marketing to Medicare beneficiaries because they can constitute Permission to Contact if configured in the right way.

- Certification

- Certification is an annual requirement to sell federally regulated Medicare-Advantage and now ACA plans. The government (CMS) has mandated that a failure to certify annually means that an agent gives up his or her right to residual income. The primary purpose for annual certification in the government’s eyes is to ensure that health agents know the rules and regulations affecting fraud, waste, and abuse as well as ethical marketing practices. Of course, they want you to be able to describe the benefits and features of the Medicare-Advantage and Prescription-Drug plans that you as an agent will be describing.

- CFR

- Code of Federal Regulations—This is the codification of the general and permanent rules and regulations (sometimes called administrative law) published in the Federal Register by the executive departments and agencies of the federal government of the United States. The CFR is divided into 50 titles that represent broad areas subject to federal regulation. The CFR annual edition is the codification of the general and permanent rules published by the Office of the Federal Register (part of the National Archives and Records Administration) and the Government Publishing Office. In addition to this annual edition, the CFR is published in an unofficial format online on the Electronic CFR website, which is updated daily.

- CMS

- Center for Medicare and Medicaid Services—This is the department of HHS that regulates Medicare, Medicaid from a federal perspective, and State Children’s Health Insurance Program (SCHIP). It enforces HIPAA, CLIA, and other health-related laws and programs. CMS regulates the carriers, who in turn regulate brokerages, agencies, and agents as well as other health-related entities.

- Coinsurance

- See Cost Sharing.

- Copayments

- See Cost Sharing.

- Cost Plans

- Medicare Cost Plans allow the beneficiaries to seek medical services in the plan’s network with the plan’s cost sharing or under Original Medicare with its cost sharing as an out-of-network option. Cost Plans are only available in certain areas of the US. Beneficiaries can enroll with Parts A and B or B only. If enrollees do not have Part A, then the plan will not cover Part A. Some cost plans have a Part D component. Regardless of whether the Part D component is taken, an enrollee may also enroll in a stand-alone Part D. Most Cost Plans are open for enrollment all year round; however, their Part D components must conform to the election-period regulations.

- Cost Sharing

- Cost-sharing is the comprehensive term that refers to the money paid by a client or beneficiary for health insurance or covered services, procedures, and goods. Cost sharing entails premiums, deductibles, copayments, coinsurance, donut holes, out-of-network costs, and non-covered services. Cost sharing is known to affect insureds’ behavior by reducing the demand for healthcare services.

-

- Coinsurance — This type of cost sharing by the client or beneficiary is an alternative to the other types like premiums, deductibles, and so on. Coinsurance is usually a percentage of the total amount owed for the procedure, service, equipment, or medication. Coinsurance does not go into effect until the deductible (if there is one) is met. Coinsurance is usually paid to the provider directly, either at the time service is rendered or when the patient is billed after the service. It is called coinsurance because the other portion is paid by the insurance company.

- Copayments — These are a type of cost sharing where money is paid by an insured to the provider to help pay for the service from the provider. The term copayment indicates that a stipulated dollar amount is owed by the patient for the procedure or benefit as opposed to a percentage (coinsurance).

- Deductible — This is a fixed dollar amount that an insured pays before the insurer starts to make payments for covered medical services. Refer to the plan’s Summary of Benefits for more information on the covered services subject to the annual deductible.

- Donut Hole — This is an informal name for the Coverage Gap. The burden of the gap or hole is being gradually decreased by Congress but will never go away entirely. By 2020, the donut hole for generic drugs will be effectively removed when beneficiaries pay a standard 25%. The story is different for brand-name drugs. Some manufacturers of brand-name drugs will or have signed an agreement with CMS to steeply discount their brand-name drugs for beneficiaries. Other manufacturers will not sign, at which point seniors will be obligated to pay full price.

- Non-Covered Services — Beneficiaries pay for services not covered by their plans. These services and procedures are also called electives or elective procedures.The cost of the procedure is paid 100% by the beneficiary.

- Out-Of-Network Costs — These costs ran the gamut. They can include the emergency or urgent care costs where copayments or coinsurance are stipulated by the plan or increased but permissible costs to visit out-of-network providers under a PPO.

- Premiums — This is a type of cost sharing where the insurance company’s liabilities are reduced regardless of the health of the insured. It is a dollar amount to be paid each month. It can be paid through deductions from Social Security, by automatic deductions from checking or savings, by credit or debit card, or by paper invoice and mailed-in check.

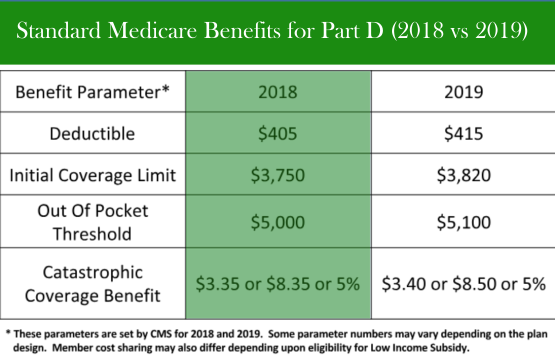

Part D has its own cost-sharing formulation separate from the health plan that covers Part-A and Part-B expenses. The costs beneficiaries pay out of pocket for drugs, called TrOOP for True Out Of Pocket, are tracked to capture what beneficiaries are actually paying as they move through the phases of Part-D coverage. TrOOP costs are calculated on an annual basis and include deductibles, copayments, and coinsurance. To facilitate TrOOP tracking by the insurance companies, beneficiaries must purchase their drugs in the participating pharmacy network. See Part D coverage (Medicare).

-

- Coverage Gap

- The Medicare Part D coverage gap (informally known as the Medicare donut hole lies between the initial coverage limit and the catastrophic-coverage threshold in the Medicare Part D prescription-drug program administered by the United States federal government. After a Medicare beneficiary exits the initial coverage of a prescription-drug plan, the beneficiary is financially responsible for a higher cost of prescription drugs until he or she reaches the catastrophic-coverage threshold. See Cost Sharing and/or Part D coverage (Medicare).

- D-SNP

- Dual Eligible Special Needs Plan—See FIDE and Medicare Coverage Options.

- Deductible

- See Cost Sharing.

- Donut Hole

- See Cost Sharing and/or Part D coverage (Medicare).

- Downstream Entity

- Business entities or individuals who are contracted to help a First-Tier Entity deliver on its contract to a CMS Sponsor (an MAO insurance company). Examples include pharmacies, doctor offices, firms providing agent/broker services, marketing firms, and call centers. This sample list is quite similar to First-Tier Entities, except they work for First-Tier Entities that have a direct contract with an MAO.

- Dual Eligibles

- The term dual-eligible beneficiaries refers to those qualifying for both Medicare and Medicaid benefits. In the United States, approximately 9.2 million people are eligible for dual eligibility status spending an estimated $319.5 billion in 2011 alone. Dual Eligibles make up 14% of Medicaid enrollment, yet spend approximately 36% of Medicaid expenditures. Similarly, the dual-eligible population totals 20% of Medicare enrollment, and spend 31% of Medicare dollars. Dual Eligibles are often in poorer health and require more care compared with other Medicare and Medicaid beneficiaries. They often qualify for D-SNP coverage. There are two categories of Dual Eligibles, those who have full dual benefits and those who have partial dual benefits. For the partial eligible benefits, see MSP below.

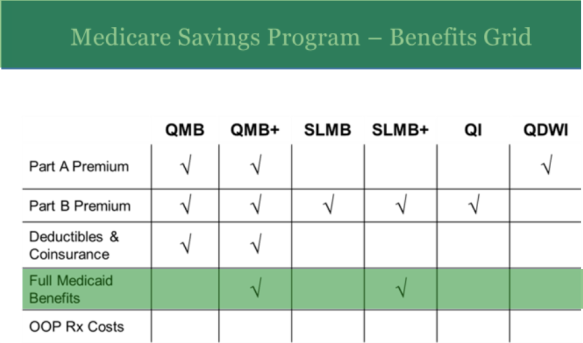

FBDE Full Benefit Dual Eligible – Persons with this status have their Medicare/Medicaid premiums, deductibles, and coinsurance paid by the state administering the Medicare Savings Program. They have a $0 cost share.

QDWI Qualified Disabled & Working Individual – This is a level of Medicaid qualification. Individuals are eligible for Medicaid payments of the Medicare Part A premiums only. They are not otherwise eligible for Medicaid. This is one of the 4 statuses that are referred to as Medicare Savings Plans or MSP. See MSP.

QI Qualifying Individual – This is a level of Medicaid qualification. Medicaid pays their Medicare Part B premiums only. They are not otherwise eligible for Medicaid benefits. This is one of the 4 statuses that are referred to as Medicare Savings Plans or MSP. See MSP.

QMB (only) Qualified Medicare Beneficiary – This is a level of Medicaid qualification. Medicaid pays their Medicare Part A and B premiums, deductibles, coinsurance, and copayment amounts only. They receive Medicaid coverage of Medicare cost-share but are not otherwise eligible for full Medicaid benefits. This is one of the 4 statuses that are referred to as Medicare Savings Plans or MSP. See MSP.

QMB+ (Plus) Qualified Medicare Beneficiary Plus – This is a level of Medicaid qualification. Medicaid pays their Medicare Part A and B premiums, deductibles, coinsurance, and copayment amounts. They receive Medicaid coverage of Medicare cost-share and are eligible for full Medicaid benefits.

SLMB (only) Specified Low-Income Medicare Beneficiary – Medicaid pays their Medicare Part B premiums only. They are not eligible for other Medicaid benefits. This is one of the 4 statuses that are referred to as Medicare Savings Plans or MSP. See MSP.

SLMB+ (Plus) Specified Low-Income Medicare Beneficiary Plus – Medicaid pays their Medicare Part B premium and provides full Medicaid benefits.

- E&O

- Errors & Omissions Insurance—The type of insurance that covers an agent or agency in case of errors in the sales, representation, or processing of health or other insurance related enrollments. It is also called professional liability insurance.

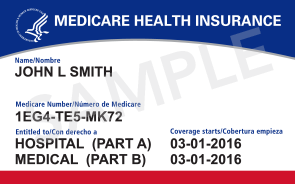

- Effective Date (Medicare)

- The effective date for Medicare services are listed on the Medicare ID cards. There are separate listings for Part A and Part B. Although in most cases the dates will be the same for parts A and B, and it will normally coincide with the month of their 65th birthday, there are many exceptions and the dates must be verified for a successful enrollment to be processed. Exceptions occur when the month of eligibility for part A is not the month the recipient enrolled in part B. This might happen when someone continues to work past age 65 and remains on health coverage provided by the employer. It can also happen when a retiree is eligible for and participates in a retirement group plan. It can happen in cases of early eligibility caused by certain health conditions. It can also happen when a Medicare recipient voluntarily delays the part B enrollment.

EGHP- Employer Group Health Plan—A group Medicare plan offered by employer, labor organization, or the trustees of a fund established by a group of employers to offer healthcare benefits to employees, former employees, or former members of the organization. The category includes individual, EGWP, 800 Series plans, and direct contracts with CMS.

- EGWP

- Employer Group ? Plan—”EGWP” can be a synonym for “EGHP.” EGWP may also be considered a type of EGHP. EGWP are plans offered by insurance carriers that are customized to the group; the customization is formalized in a contract.

- Election Periods

- These are periods of time where a person can enroll or disenroll in Original Medicare, Part C, or Part D. These periods are often ranked. This enables individuals, insurance companies, and Medicare to use the lower-ranked election periods first, saving the higher ones to correct problems realized after the initial election. Ranking from top to bottom, they are:

- ICEP or IEP—Initial Coverage Election Period or Initial Election Period.

- IEP—New to Medicare and enrolling into a plan for the first time, whether an MAPD or stand alone PDP. If the plan includes Rx coverage, this is the enrollment option that applies. The IEP begins 3 months prior to the first month of eligibility (usually their birthday month) and continues for 7 months.

- IEP2—This is a new initial election period for those continuing with Medicare after being enrolled prior to age 65 because of illness or disability. The beneficiary has a new IEP when turning 65. The same rules apply as for IEP. The IEP2 begins 3 months prior to their birthday month and continues for 7 months.

- ICEP—(1) The member is enrolling for the first time during their initial enrollment period (their birthday month and continuing for 7 months) but elects to purchase a plan without Rx coverage (MA-Only). (2) Enrolling in an MA or MAPD after a delayed enrollment in part B

- SEP—See SEP as a main heading in this document.

- AEP–Annual Enrollment Period or Annual Election Period—The annual period where a Medicare-Advantage beneficiary can select the plan that suits them best from those plans available in their area. Such plans are generally guarantee issue other than for certain health conditions like ESRD. PDP’s or prescription drug plans also become available to all beneficiaries during this enrollment period. SEP’s may allow other enrollment options.

- OEP—Open Enrollment Period—This term has 2 uses. (1) The best time to buy a Medicare Supplement policy is during the 6-month Medicare-Supplement Open Enrollment Period, because you can buy any Medicare-Supplement policy sold in your state, even if you have health problems, for the same price as people with good health. This period automatically starts the month you turn 65 and you are enrolled in Medicare Part B. Contrast this with a Guarantee-Issue Period. (2) There is an annual Open Enrollment Period, the OEP, from Jan 1 to Mar 31 for Medicare Advantage. To be eligible for this enrollment period, a person needs to already have a Medicare Advantage plan; those those who are on Original Medicare with a Medicare Supplement are not eligible. During this period, someone on an MA plan since the first of January may switch to another MA plan or return to Original Medicare. Those with or without drug coverage in their MA can switch to the opposite type of drug coverage. For instance, someone in an MAPD could go to Original Medicare, enroll in a Stand-Alone Part D plan, and enroll in a Medicare Supplement. Someone who gets prescription drug coverage through the VA could drop his MAPD and enroll in an MA-Only. Those beneficiaries enrolled in Part-D Stand-alone plans are not eligible for the OEP.

- OEPNEW—Open Enrollment Period for Newly Eligible Individuals—The OEPNEW allows individuals who enrolled in an MA plan with their ICEP/IEP to change their mind one time after their initial enrollment. The OEPNEW begins the day that coverage by Medicare Parts A & B begins and ends on the last day of the third month.

- OEPI—Open Enrollment Period for Institutionalized individual—The OEPI is continuous for eligible individuals who meet the definition of “institutionalized” to enroll in or disenroll from a Medicare Advantage Special Needs Plan for institutionalized individuals. It ends 2 months after the individual moves out of the institution. Plans are not required to be open to enrollment during the OEPI, but if they are open for one, they are open for all; however, all plans must be open for disenrollment during OEPI. See Medicare Coverage Options, and MOC.

- Enrollment Periods

- See Election Periods.

- EOC

- Explanation of Coverage—This is a document/booklet given at the beginning of coverage. It explains in detail what the plan covers as opposed to the Summary of Benefits given to Medicare beneficiaries when they enrolled. It also explains member responsibilities under the contract. Everyone is supposed to read it; very few do. When you have a question about what is actually covered and what is not, this is the definitive document. Insurance carriers will read it such that fewer procedures are covered while insureds will read it such that more procedures are covered.

- EPLS

- Excluded Parties List System—The United States General Services Administration (GSA) administers the EPLS, which contains debarment actions taken by various Federal agencies, including the OIG. You may access the EPLS on the System for Award Management website.

- ESRD

- End Stage Renal Disease—ESRD is one of the primary reasons Medicare was created. ESRD generally indicates you are or will be receiving kidney dialysis and waiting for a kidney transplant. A beneficiary with ESRD is generally not eligible to enroll in a Medicare Supplement; their condition is taken care of through Original Medicare or Medicare Advantage starting in 2021.

- Extra Benefits

- Extra Benefits may be confused with Optional Supplemental Benefits. However, usage seems to make a distinction. The term extra benefits seems to refer to benefits that are not offered by Original Medicare and which are embedded in a Part-C Plan’s regular benefits. The term optional supplemental benefits seems to refer to benefits that are offered as riders on a Part-C plan with additional premium due. The most common additional benefits pertain to dental, hearing, and vision benefits. If they are embedded in a plan, they are extra benefits. If they cost an additional premium, they are optional supplemental benefits.

- Extra Help

- This is the federal program also called low-income subsidy.

- FEHB

- Federal Employees Health Benefits program—This is a system of managed competition through which employee health benefits are provided to civilian government employees and annuitants of the United States government. The government contributes 72% of the weighted average premium of all plans, not to exceed 75% of the premium for any one plan (calculated separately for individual and family coverage). The FEHB program allows some insurance companies, employee associations, and labor unions to market health insurance plans to governmental employees. The program is administered by the United States Office of Personnel Management (OPM).

- FBDE

- Full Benefit Dual Eligible—See Dual Eligibles.

- FDR

- First-Tier, Downstream, or Related Entity—This is a categorization of private-sector businesses that refers to any entity or individual helping a CMS Sponsor fulfill its obligations to CMS. It applies to people and entities who are subject to CMS rules and regulations, either directly or indirectly. Consider the following, more specific description from AHIP:The Part C Plan Sponsor is a CMS Contractor. Part C Plan Sponsors may enter into contracts with FDRs. This stakeholder relationship flow chart shows examples of functions that relate to the Sponsor’s Medicare Part C contracts. First Tier and related entities of the Medicare Part C Plan Sponsor may contract with downstream entities to fulfill their contractual obligations to the Sponsor.Examples of first tier entities may be independent practices, call centers, health services/hospital groups, fulfillment vendors, field marketing organizations, and credentialing organizations. If the first tier entity is an independent practice, then a provider could be a downstream entity. If the first tier entity is a health service/hospital group, then radiology, hospital, or mental health facilities may be the downstream entity. If the first tier entity is a field marketing organization, then agents may be the downstream entity. Downstream entities may contract with other downstream entities. Hospitals and mental health facilities may contract with providers.

- FFS

- Fee For Service—This was a business model established by physicians and other healthcare providers to cover the costs of the diagnoses and treatments. As spiralling health costs and Population Health Management concerns occupy government attention, FFS has come to signify providers who do not take the time to communicate well with the other providers looking after a particular patient. This lack of coordination across healthcare businesses leads to poor outcomes, a lack of clear accountability, treatments that garner compensation for providers without any discernible benefits for the patients, and so on. The US government is pushing the healthcare industry to do away with this model through initiatives like MACRA, ACO, and so on.

- FIDE

- Fully Integrated Dual Eligible—These D-SNPs were created by Congress as part of the Affordable Care Act. They are intended to enable the full integration and coordination of Medicare and Medicaid benefits under the auspices of a single carrier. They must meet 5 criteria: (1) they enroll special-needs individuals entitled to medical assistance under a Medicaid plan negotiated with the State; (2) they provide benefits to dual eligible individuals as part of one plan from a single carrier; (3) they have a CMS-approved, MIPPA-compliant contract with a state Medicaid agency that covers primary, acute, and long-term care benefits; (4) they coordinate the delivery of Medicare and Medicaid benefits through the alignment of a care-management and a specialty-care network attuned to high-risk individuals; (5) they employ policies and procedures approved by CMS and the State to coordinate and integrate enrollment, member materials, communications, grievance and appeals, and quality improvement.

- First-Tier Entity

- A business entity or individual that enters into a valid written contract directly with a CMS sponsor (insurance carrier) to provide administrative or health-care services. Examples are Pharmacy Benefit Management (PBM), hospital or health care facility, provider group, doctor office, clinical laboratory, customer service provider, claims processing and adjudication company, a company that handles enrollment, disenrollment, and membership functions, and contracted sales agent [Is this a particular kind of sales agent?]. This definition includes any employees of First-Tier Entities. Notice, first-tier entities do not include Sponsors but are contracted with Sponsors. Compare Sponsors and Downstream Entity.

- FMV

- Fair Market Value—The FMV is an amount published each year by CMS on a state-by-state basis that will be paid to a licensed and certified producer for enrolling a new beneficiary in a Medicare Advantage plan.

- FPL

- Federal Poverty Level—A benchmark determined yearly to help identify who is eligible for Medicaid and LIS benefits.

- Fraud

- Knowingly and willfully executing, or attempting to execute, a scheme or artifice to defraud any healthcare benefit program; or to obtain, by means of false or fraudulent pretenses, representations, or promises, any of the money or property owned by, or under the custody or control of, any healthcare benefit program.—18 United States Code §1347

- FSA

- Flexible Spending Accounts—Also known as Cafeteria Plans, Flex Plans, or Section 125 plans. Such accounts let you set aside a certain amount of your paycheck into a Medical Reimbursement Account or Dependent Day Care Reimbursement Account before you pay income and FICA taxes. This can save you 26%-36% of out-of-pocket costs, depending on your tax rate.

- FWA

- Fraud, Waste, and Abuse—These are the activities that cause an inefficient or bad use of taxpayer money. The individual definitions have been placed under the separate definitions of fraud, waste, and abuse.

- Full Dual

- The following Medicaid levels have full dual benefits as opposed to partial dual benefits. Full dual-benefits recipients are FBDE, QMB, QMB+, and SLMB+. See Dual Eligibles.

- GI

- Guarantee Issue—This is a term used in the health-insurance industry to describe a situation where a policy is offered to any eligible applicant without regard to past or current health status. Often this is the result of guaranteed-issue statutes regarding how health insurance may be sold, or to provide a means for people with pre-existing conditions the ability to obtain health insurance of some kind. It has been part of the Medicare Supplement business for a while and now governs all health insurance policies sold under the Patient Protection and Affordable Care Act (ACA). Prior to the ACA, a small number of states required insurers to sell all coverage on this basis in the individual health insurance market. In addition, the “creditable coverage” provisions of the Health Insurance Portability and Accountability Act of 1996 are often considered to be a federal guaranteed issue regulation which some states fulfilled using a high-risk pool program. Under Medicare, a GI happens when leaving a group or losing other coverage that changes in some way, giving you a Special-Election/Enrollment-Period (SEP). The plan will be issued without underwriting, but could be at a higher rate than Open-Enrollment-Period (OEP) enrollments. In other cases, you have a trial right to try out a Medicare Advantage Plan (Part C), but you may revert to a Medigap policy if you change your mind within 12 months. Some plan options may not be available under GI, and certain states may offer additional guarantees like the ability to switch plans during your annual renewal or your birthday month.

- Gorman

- Gorman is a health care industry consultancy and technology firm. As such, they provide turn-key solutions for smaller insurance companies that do not wish to to develop their own certifications and/or contracting websites. Depending on their agreement with a carrier, they may accept AHIP certification as a portion of the training, or may require their own substitute course be taken by an agent seeking certification.

- HDHP

- High Deductible Health Plan—In the United States, a high-deductible health plan is a health insurance plan with lower premiums and higher deductibles than a traditional health plan. Being covered by an HDHP is also a requirement for having a health savings account. Some HDHP plans also offer additional wellness benefits, provided before a deductible is paid. High-deductible health plans are a form of catastrophic coverage, intended to cover for catastrophic illnesses.

- HHS

- Department of Health and Human Services—This is a federal Cabinet-level department directed by the HHS Secretary who reports directly to the president of the United States. The Department oversees the FDA, Indian Health Services, Centers for Disease Control and Prevention (CDC), Office of the Surgeon General, Office of the Inspector General, Administration for Children and Families (ACF), Medicare and Medicaid (CMS), as well as many other health and human services related programs and is responsible for more of the US government spending than any other department.

- HIP

- Hospital Indemnity Plans—These are insurance plans that pay cash when a beneficiary is admitted for inpatient care, on either a per day or per stay basis. The plans are intended to cover the dangers associated with the coinsurance required in most health plans. The cash can also be used to cover other expenses, since no one dictates how the cash is to be used.

- HIPAA

- Health Insurance Portability and Accountability Act—HIPAA is the federal law enacted in 1996. The primary goal of the law is to make it easier for people to keep health insurance, protect the confidentiality and security of healthcare information and help the healthcare industry control administrative costs.

- HITECH

- Health Information Technology for Economic and Clinical Health—The Health Information Technology for Economic and Clinical Health (HITECH) Act, enacted as part of the American Recovery and Reinvestment Act of 2009, was signed into law on February 17, 2009 to promote the adoption and meaningful use of health information technology. Subtitle D of the HITECH Act addresses the privacy and security concerns associated with the electronic transmission of health information, in part, through several provisions that strengthen the civil and criminal enforcement of the HIPAA rules. Section 13410(d) of the HITECH Act, which became effective on February 18, 2009, revised section 1176(a) of the Social Security Act (the Act) by establishing:

- Four categories of violations that reflect increasing levels of culpability;

- Four corresponding tiers of penalty amounts that significantly increase the minimum penalty amount for each violation; and

- A maximum penalty amount of $1.5 million for all violations of an identical provision.

It also amended section 1176(b) of the Act by:

- Striking the previous bar on the imposition of penalties if the covered entity did not know and with the exercise of reasonable diligence would not have known of the violation (such violations are now punishable under the lowest tier of penalties); and

- Providing a prohibition on the imposition of penalties for any violation that is corrected within a 30-day time period, as long as the violation was not due to willful neglect.

- HMO

- Health Maintenance Organization—See Medicare Coverage Options.

- HMO-POS

- HMO with Point Of Service Option—A point-of-service option intends to address the feeling that some patients have of being constrained by straight HMO plans. A POS allows a patient to choose to see a specialist when she wants, in exchange for paying higher copayments or coinsurance when visiting doctors outside of the network.

- HPMS

- Health Plan Management System—HPMS is a CMS-administered, web-enabled information system that serves a critical role in the ongoing operations of the Medicare Advantage (MA), Part D, and Accountable Care Organization (ACO) programs. HPMS services the MA and Part D programs in two central ways. First, HPMS functionality facilitates the numerous data collection and reporting activities mandated for these entities by legislation. Second, HPMS provides support for the ongoing operations of the plan enrollment and plan compliance business functions as well as for longer-term strategic planning and program analysis.

- HRA

- Health Reimbursement Arrangement or Account—HRAs are US Internal Revenue Service (IRS)-sanctioned, employer-funded, tax-advantaged employer health benefit plans that reimburse retirees for out-of-pocket medical expenses and individual health insurance premiums. Employees who are 65 or older and continue to work are not eligible for HRA’s.

- HSA

- Health Savings Account—An HSA is a tax-advantaged, medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP). The funds contributed to an account are not subject to federal income tax at the time of deposit. HSA’s participation ceases once a person accepts Medicare Part A.

- I-SNP

- Institutional Special Needs Plan—See Medicare Coverage Options.

- ICL

- Initial Coverage Limit—This is an amount associated with the Part D coverage gap or donut hole. It is the total amount spent by both the insurance company and the Medicare beneficiary, so it may be considered the retail value of the medications. Once the initial-coverage limit is reached, the beneficiary enters the donut hole until catastrophic coverage begins. See Part D coverage (Medicare).

- IEP/ICEP

- Initial Enrollment Period / Initial Coverage Election Period See Election Periods.

- IRMAA

- Income-Related Monthly Adjustment Amount—If you have a higher income, you will pay an additional premium amount for Medicare Part B and Medicare Prescription Drug Coverage.

- Part B—If you are a higher-income beneficiary, you will pay a larger percentage of the total cost of Part B based on the income you report to the Internal Revenue Service (IRS). If you must pay higher premiums, you will receive a letter with your premium amount(s) and the reason for the determination.

- Prescription Drug Plan costs vary depending on the plan. If you are a higher-income beneficiary with Medicare prescription drug coverage, you will pay monthly premiums plus an additional amount, which is based on what you report to the IRS. This amount is deducted from your monthly Social Security payment regardless of how you ordinarily pay your monthly prescription plan premium. If the amount is greater than your monthly payment from Social Security, or you do not get monthly payments, you will get a separate bill from CMS or the Railroad Retirement Board.

Late Enrollment Penalties

- In Medicare there are 2 late enrollment penalties to be aware of.

- Late enrollment into part B coverage occurs when a recipient fails to enroll when first becoming eligible and no other creditable coverage is in force. Enrollment for part B is then deferred until the General Enrollment Period which happens annually January 1st through March 31st. Once enrolled during the General Enrollment Period, part B coverage will begin July 1st of that year. There will be a 10% penalty added to the cost of the Part B premium for each year or partial year that coverage was not in force. On July 1st you will have an SEP to enroll in a plan.

- The PDP Late Enrollment Penalty currently works differently from the outdated understanding of most Medicare insurance agents. The obsolete notion that the drug LEP is 1% of the average of national plan premiums and that it is applied for each month coverage was not in place when it could have been. An updated understanding knows that the LEP is based on 1% of the base beneficiary premium, an amount that is lower than the national average. For instance, the national average premium for 2019 was calculated at $51.28 while the base beneficiary premium was $33.19. (See base beneficiary premium.) This amount is calculated every year by CMS and applied as a penalty for that year, so the amount of the penalty can rise and fall (but mostly rise) over time.

These penalties are indefinite and will continue as long as the recipient is enrolled in a plan.

- LEIE

- The List of Excluded Individuals and Entities is used by the HHS OIG to stipulate and publish individuals who are excluded from prescribing, furnishing, or fulfilling any item or service for federally funded health-care programs. In practice, individuals and entities cannot work for programs overseen by HHS or CMS.

- Licensing

- Licensing is used in two ways: (1) authorization from a state government to sell insurance, and/or (2) authorization from a carrier to represent it by selling its insurance products. It is common for people who have been in the insurance industry for quite a while to say licensing when referring to the entire process. However, technically speaking, licensing is authorization from the state while appointment is authorization from an insurance carrier. The precise way to speak of this process is licensing and appointing.

- LIS

- Low Income Subsidy (aka Extra Help or Low Income Assistance)—Medicare beneficiaries with limited resources and income are eligible for Extra Help to pay for their share of the prescription drug coverage. Individuals eligible for Extra Help receive a full or partial subsidy up to the benchmark premium for a base plan. To get Extra Help, Medicare beneficiaries must enroll in a Medicare-approved prescription drug plan.

- Agents should encourage beneficiaries with limited income and few assets to apply to their state Medicaid and/or Social Security Administration Office for Extra Help. Beneficiaries may apply at any time. If they apply at the state’s Medicaid Office for Part D help, the office may also check their eligibility for other low-income assistance programs. Beneficiaries may call the SSA at 1-800-772-1213 or apply online at www.socialsecurity.gov/prescriptionhelp See also Dual Eligibles.

- LPI

- Low Performer Icon—CMS requires carriers who have had a rating below three stars for three consecutive year to display the “Low Performance Icon.” If beneficiaries do not switch at AEP, then CMS will inform them that they have a one-time chance to switch to a plan with three or more stars. LPI performers must not dispute the rating in their literature, cannot mention star ratings without mentioning their low-performance status. Agents cannot encourage enrollment by telling enrollees that they will receive an SEP to enroll elsewhere if they are dissatisfied.

- LTC insurance

- Long-Term Care insurance—This term refers a policy that covers a continuum of medical and social services designed to support the needs of people living with chronic health problems that affect their ability to perform everyday activities. Long-term-care services include traditional medical services, social services, and housing. LTC is opposed to acute care, the type of care covered by major medical insurance and Medicare insurance. In recent years, long-term care reserving requirements were raised by the government; qualification has become more difficult; carriers have exited the business; premiums have risen dramatically. For this reason, LTC insurance is being replaced by short-term-care insurance.

- MA

- Medicare Advantage—See Medicare Coverage Options

- MA-Only

- Medicare Advantage without prescription drug coverage. See Medicare Coverage Options.

- MACRA

- Medicare Access and CHIP Reauthorization ACT of 2015—This Act, which went into effect in July of 2015, replaces the Sustainable Growth Rate (SGR) formula for government payments to physicians and other providers with performance-based pay. The Act’s impact on providers, on the activities surrounding their delivery of health-care services, and on how they will be/are paid, will be far reaching. The Act reinforces the announcement in January 2015 from Health and Human Services about accelerating the shift of Medicare spending into value-based payment models. MACRA defines new treatment and payment models for the government to follow as it pays providers for outcomes rather than services. Consequently, MACRA establishes measurements of service quality that were formerly voluntary measurements that started being recorded in 2017 although payments by the government will not be based on these measurements until some time down the road. It keeps getting pushed out.

- MADP

- Medicare Advantage Disenrollment Period—An obsolete enrollment period. It was last exercised in January and February of 2108. It has been replaced by the Open Enrollment Period; the initial OEP was in 2019.

- MAO

- Medicare Advantage Organization—This is an insurance carrier with an MA health plan under contract with CMS.

- MAPD

- Medicare Advantage with Prescription Drugs—Medicare Advantage coverage with embedded prescription-drug coverage. See Medicare Coverage Options.

- MBIs

- Medicare Beneficiary Identifiers—These identifying numbers replaced HICN’s starting in April 2018 and finishing in April 2019. The new numbers are intended to make fraud and identity theft more difficult, protecting both Medicare beneficiaries and the government from the thieves. The new MBIs are used for billings, claim status, eligibility status, and other interactions with the Medicare Administrative Contractor (MAC). The numbers for Railroad-Retirement-Board eligibles will no longer be distinct, although an RRB logo appears on the new cards. The MBI’s format is still 11 characters long, containing numbers and uppercase letters, but is now unique to each person with Medicare. It will be clearly different from the HICN. Medicare will use numbers 0-9 and all letters from A to Z, except for S, L, O, I, B, and Z, which will help make the characters easier to read.

- MCMG

- Medicare Communications and Marketing Guidelines—CMS expanded the guidelines to cover more than just marketing communications, since operational communications had been considered marketing communications, and had to adhere to the marketing restrictions.

- Medicare Advantage

- See Medicare Coverage Options.

- Medicare Coverage Options

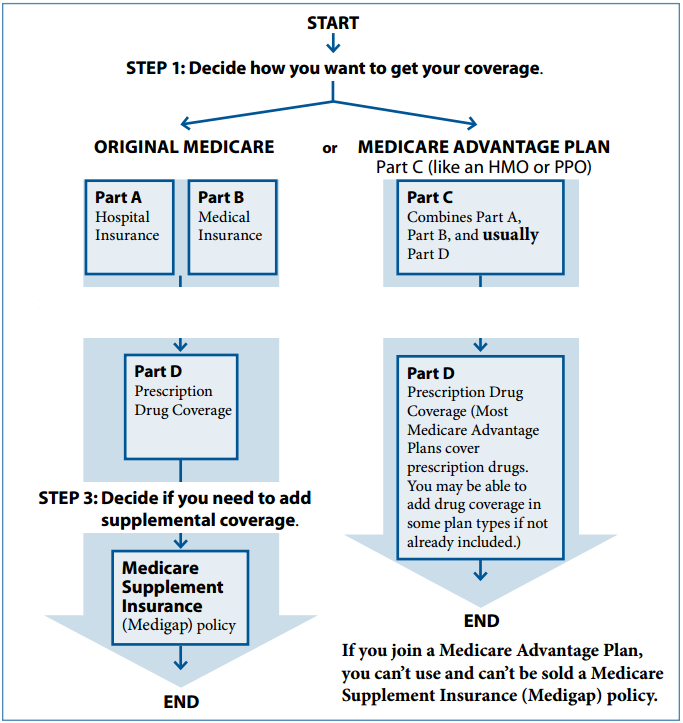

- Medicare benefits are available through two different channels or options: Original Medicare or Medicare Advantage. Both options cover the same basic health care needs, but they do it in different ways. You will have to choose one or the other.

- Original Medicare—After many years of congressional debate, Original Medicare was signed into law in 1965 by President Lyndon B. Johnson as a health insurance program for the elderly. It was later expanded to include younger beneficiaries with certain ailments or disabilities. Because of the deductibles and copays associated with original Medicare, a desire for drug coverage, a need to limit out of pocket costs, and so forth, private insurance companies created Medicare Supplements to address those needs. Supplements, also known as Medigap Plans, work hand in hand with original Medicare providing coverage according to the specific plan design (See: Medicare Supplements). When using Original Medicare, there are no networks of providers or service areas to worry about (a few Medicare Supplements do have networks). As long as a provider accepts Medicare, then Original Medicare and a Supplemental plan can be presented for covered services. Drug plans, once available within certain Supplemental plans, are now available as a stand alone option offered through the Medicare program as Part D coverage.

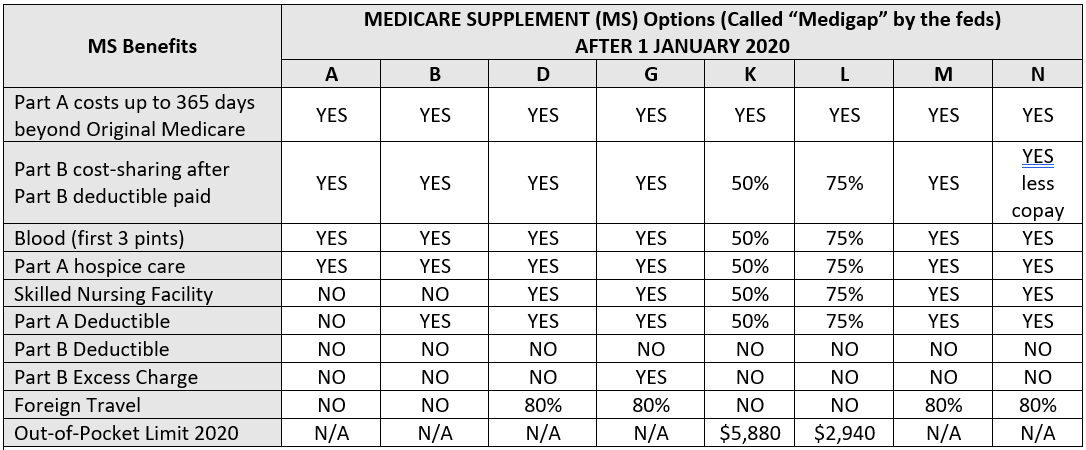

- Medicare Supplement (aka Medigap)—Medicare supplement plans are private insurance plans that are designed to work hand-in-hand with Original Medicare for the purpose of reducing or eliminating cost sharing exposure. A significant legislative change to Medicare—called the Medicare Modernization Act or MMA—was signed into law by George W. Bush, in 2003. This law further standardized supplement plans so that each insurance company would be offering the same plan benefits to retirees. If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies are standardized in a different way from the rest of the country. They may be called Basic, Expanded, Core, or Sup 1.

- Medicare Advantage (MA) came into existence in 1997, originally called Medicare+Choice. This program is a replacement for Original Medicare, but a beneficiary can always return to original Medicare if they are not happy with the MA program. Medicare Advantage (also known as Medicare Part C) incorporates the two aspects of Original Medicare, Part A (Hospital Coverage) and Part B (Medical Insurance) and usually adds Part D (Prescription Drug Coverage). Private insurance companies are paid, through Medicare, a certain dollar amount per enrollee based upon the historic cost of services in a plan’s service area, their star rating, and the health of their enrollees. The plan is then responsible to provide all Medicare services to the enrolled beneficiary. Medicare is then no longer directly involved with the administration or payment of any medical services obtained by the beneficiary. Medicare does retain oversight responsibility with the plans and may get involved with complaints or other compliance type of issues. There are several ways to classify Medicare Advantage plans (1) by the inclusion or exclusion of drug coverage, (2) by a beneficiaries legal ability to simultaneously enroll in a Stand-Alone Part D, and (3) by the management design embodied in the plan. These three classifications can overlap.

MA Plan Categories by Exclusion or Inclusion of Drug Coverage- MA-Only—A class of Medicare health plans offered by private insurance companies that contract with Medicare to provide you with all your Part A and Part B benefits, but not your Part D or prescription drug benefits. These plans coordinate with coverage like Tricare for Life or Veterans Administration. They also accommodate those who choose not to take medications for one reason or another like morality or philosophy.

- MAPD—A class of Medicare health plans offered by private insurance companies that contract with Medicare to provide you with all your Part-A, Part-B, and Part-D benefits. The vast majority of Medicare Advantage Plans offer prescription drug coverage. This is the only way to get prescription drug coverage for a $0 premium, since all Stand-Alone Part-D plans have premiums.

MA Plans that Allow Simultaneous Stand-Alone Enrollment

- MSA—By law, MSA are forbidden from offering drug coverage. If someone wants drug coverage, they need to purchase a Stand-Alone Precription Drug Plan.

- PFFS—PFFS plans are granted liberties with networks, including pharmacy networks. Consequently, PFFS can choose to provide drug coverage as part of the benefit package or to allow enrollees to purchase separate stand-alone Part-D coverage.

MA Plan Types by Design

- HMO—A health maintenance organization seeks to avoid duplication and conflicts among diagnostic and treatment procedures. For this reason, it is often called managed care. A common way of ensuring this type of management is to require referrals from a general practitioner for seeing specialists. Usually, previous diagnostic results are shared, reducing costs. The costs of such an approach are that patients often feel that they cannot choose which doctor to see and when to see them. There is a specialized type of HMO:

- HMO-POS—These plans do not require referrals from PCP’s and have higher cost sharing if the beneficiary seeks treatment outside the provider network. (So why are they not PPO’s?)

- MSA—(Medicare) Medical Savings Accounts are plans that combine a high deductible health plan with a trust or custodial bank account. The plan deposits money from Medicare into the account. The beneficiary can use it to pay medical expenses until the high deductible is met; however, only Medicare expenses are covered, so no over-the-counter, dental fillings, or other non-Medicare expenses count toward the deductible even if they are tax deductible (see IRS Publication 502). MSA plans do not cover prescription medications, but beneficiaries are allow to enroll in PDP’s. MSA’s do not accept SEP enrollments or disenrollments; a person can enroll only during ICEP or AEP. Members cannot disenroll by calling 800-Medicare but must call the carrier, a difference from all other MA plans since two contracts must be terminated, something that Medicare will not do

- PFFS—Private Fee For Service plans today grant plan designs liberty with the provider networks. Most PFFS plans have networks but can forego them in areas where the population is small or there are not enough provider options to create networks that meet federal criteria. Although PFFS are used less often than in the past, they may be found in rural areas of the country. Private fee for service plans are not Medicare Supplements, and do not work with Original Medicare like a Medigap plan would. When there is a network, you know you may present your card to any of the network providers for service. Outside of the network you may go to any doctor or provider who accepts Medicare (both in and out of your home state) and is willing to accept the terms and conditions of the carrier for payment. Providers are allowed to accept the plan on a patient-by-patient and a vist-by-visit basis. In other words, a provider can decide that although he has seen a patient with a certain condition for six months, he loses too much per visit and so decides not to accept the plan. There may be cost sharing or balance billing in some cases and the provider can accept or decline the insurance on a case by case basis. So, the beneficiary must verify acceptance of the plan prior to service. All PFFS plans are required to display this disclaimer: “A Private Fee-for-Service plan is not a Medicare supplement plan. Providers who do not contract with our plan are not required to see you except in an emergency.”

- PPO—Preferred Provider Organizations are allowed to discriminate when it comes to providers. They give enrollees two alternatives: they can obtain their services from providers who have agreed to specific terms and conditions and have become part of the insurance company’s network or they can obtain services from providers who have not signed such agreement. If a beneficiary seeks services inside the network, he or she usually pays lower cost sharing. If a beneficiary seeks services outside of the network, he or she usually pays higher out of pocket costs like copayments and coinsurance. There are 2 types of PPO’s:

- Regional PPO’s—A regional PPO can serve one of the 26 regions established by CMS. The service area along with its doctors, hospitals, labs, and pharmacies become available to beneficiaries living in the service area. CMS regions enable single-state or multi-state service areas as opposed to the smaller service areas of local PPO’s.

- Local PPO’s—A local PPO is designed for one or more counties in a single state. The service area includes only those who live in the counties and the doctors, hospitals, and pharmacies near them in the same service area.

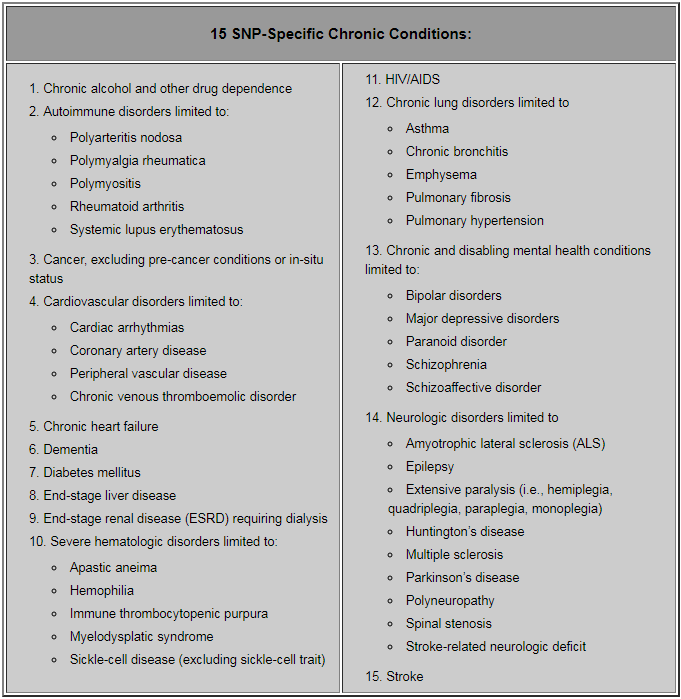

- SNP—Special Needs Plans always have HMO or PPO benefit packages and are designed for people with special health-care needs. Examples of the specific groups with special needs include people who have both Medicare and Medicaid (called dual eligibles), people who have certain chronic medical conditions like diabetes, and people who reside in institutions. All SNPs must include prescription-drug coverage. They may enroll people with ESRD if they obtained a waiver from CMS during plan design. In 2017, there were 2.3 million people enrolled in SNPs, or about 12% of the total Medicare Advantage enrollment.

- C-SNP or CSNP—These Medicare Advantage plans have specialized design for severe or disabling chronic conditions. The list of chronic conditions is established and maintained by CMS. Two thirds of of Medicare beneficiaries suffer from multiple chronic conditions, which require coordination among primary-care physicians, specialists for medical and mental health, inpatient and outpatient facilities, and ancillary services like diagnostics and therapy management. CMS requires the plan to contact the applicant current physician to verify the applicant’s condition. The condition must be verified annually by the plan. The individual has a special election period to enroll in the C-SNP; once enrolled, the individual then has only regular election periods.

-

- D-SNP or DSNP—These are dual-eligible special needs plans. They are both Medicare Advantage plans (contracted with and regulated by the Federal Government) and state plans contracted with and regulated by the state Medicaid program. Members must be eligible for both Medicare and Medicaid benefits to enroll. (By the way, D-SNP’s are not MMP’s and vice versa.) See MMP.

- I-SNP or ISNP—These are Medicare Advantage plans with specialized design for individuals who will be institutionalized for 90 days or more. Qualifying institutions include long-term care (LTC) skilled nursing facilities (SNF), LTC nursing facilities (NF), combinations of SNF/NF, intermediate care facilities (ICF) for individuals with intellectual disabilities (IID), and inpatient psychiatric facility. I-SNP plans may also enroll individuals living in the community who require a level care equivalent to institutionalized individuals–such plans are know as Institutional Equivalent SNPs. I-SNP plans must be able to demonstrate that they can implement the MOC’s required by institutionalized individuals. Individuals use the OEPI election period, which is continuous valid until 2 months after the individual moves out of the institution. See MOC.

- Medicare Enrollment

- The government automatically enrolls some people in both Parts A and B when they turn 65.(1) People who are already receiving benefits from Social Security or The Railroad Retirement Board (they are allowed to refuse Part B), (2) disabled people under the age of 65 who have received Social-Security or Railroad-Retirement benefits for 24 months (they too can refuse Part B), and (3) people with ALS are signed up the month their Social Security disability begins. The government requires most people to deliberately sign up during their initial enrollment period (3 months before turning 65 + month of birthday + 3 following months). People with ESRD may sign up at any time, although coverage does not usually begin until the 4 month of dialysis.

- Medicare Preventive Coverage (List of Potential Services)

- Abdominal aortic aneurysm screening

- Alcohol misuse screenings & counseling

- Bone mass measurements (bone density)

- Cardiovascular disease screening

- Cardiovascular disease (behavioral therapy)

- Cervical & vaginal cancer screening

- Colorectal cancer screening

- Depression screening

- Diabetes screenings

- Diabetes self-management training

- Flu vaccinations

- Glaucoma tests

- Hepatitis C screening test

- HIV screening

- Lung cancer screening

- Mammogram screenings

- Nutrition therapy services

- Obesity screenings & counseling

- One -time “Welcome to Medicare” preventive visit

- PAP tests

- Pelvic exams

- Prostate cancer screenings

- Sexually transmitted infections screening & counseling

- Vaccines including Flu shots, Hepatitis B shots, Pneumococcal shots

- Tobacco use cessation counseling

- Yearly “Wellness” visit

- Medicare Supplement (aka Medigap)

- Medicare Supplement, the term used by the insurance industry and the broad market, has been replaced in federal literature by the term Medigap. It seems that carriers and states tend to prefer the term Medicare Supplement since the market expects that term. As an agent, you need to know that most agers-in believe any Medicare coverage is called Medicare Supplement, so be prepared to listen flexibly. The conflict may also be construed as evidence of the disagreement regarding jurisdiction between federal and state agencies.

- MIPS

- Merit-based Incentive Payment System—This payment system, designed to replace Sustainable Growth Rate (SGR) payments, is defined and established by MACRA (see the term’s definition within this glossary) for those providers who wish to remain in a Fee-For-Service (FFS) practice. Both FFS and SGR have shown that they are not good at population health management. Under MACRA, MIPS is an alternative to Alternative Payment Models (APM), a much less well-defined approach that allows for cost-saving innovations down the road. The way MIPS is structured encourages providers to repudiate FFS and adopt service and payment models more suitable for population health management, ways suggested by ACO. The effect is for providers to adopt the much less predictable APM (alternative payment models), which would maximize government flexibility in reengineering the healthcare system down the road. MIPS is further structured to offset its predictability by imposing some risk on providers, risk based on their performance under a weighted formula composed of quality, efficiency, meaningful use, and clinical practice-improvement activities. Somewhat analogous to value-based purchasing, MIPS includes both a bonus and penalty structure. An increasing percentage of payment is at risk each year. See APM, MACRA, SGR.

- MLN

- Medicare Learning Network—The MLN is the source of official information published by CMS for health-care professionals. http://go.cms.gov/MLNgenInfo

- MMP

- Medicare-Medicaid Plan—These plans are similar to but distinct from D-SNP’s. They consist of a contract among 3 parties: Medicare, Medicaid, and the health-plan carrier. The plans are subject to Medicare Advantage rules unless the state modifies the contract. Here is a brief comparison of MMP’s and D-SNP’s.

- MMP’s

- Includes Medicaid benefits built into the plan’s design

- Offers single billing process for all providers

- Not offered by every state

- D-SNP’s

- Plan designs not required to include Medicaid benefits

- Providers may have to separately bill Medicare, the state Medicaid office, and the insurance carrier

- Available in most states, although the size of the service areas vary by state, carrier, and plan

See Medicare Coverage Options.

- MMP’s

- MOC

- Model of Care—Each institution that accept I-SNP plans is required to develop a Model of Care with specific goals and objectives for the population it will be serving. Models deal with the following points:

-

- Measurements—Measure performance against meeting the needs of members with multiple or complex conditions.

- Training—Train providers, employees, and contractors to ensure an understanding of the MOC.

- Staffing—Maintain a staqffing structure with care-management roles designed to manage SNP members.

- Health Risk Assessments (HRA)—Assess SNP members’ physical, behavioral, psychosocial, and functional needs using HRAs. An initial HRA is performed for all new SNP members and annually thereafter.

- Interdisciplinary Care Team (ICT)—Assign an ICT to each member, review care plans, collaborate with network providers, and provide recommendations for management of the member’s care.

- Communication—Establish a communication network between members, providers, and plan staff to support information sharing.

- Clinical Practice Guidelines—Use of clinical practice guidelines and current standards of care.

- Results—Helping to improve performance and health outcomes by collecting, analyzing, and reporting results.

- Evaluation—Annual formal evaluation of the effectiveness of the MOC. Results of the evaluation and subsequent MOC changes are communicated to all stakeholders, including members, providers, and internal departments.

See Medicare Coverage Options and the SNP and I-SNP subheadings.

-

- MSA

- (Medicare) Medical Savings Account—See Medicare Coverage Options.

- MSP

- Medicare Savings Plan—This is federally funded program that is administered by a state’s Medicaid program. It helps to pay premiums, deductibles, and coinsurance for people who are not FBDE yet still qualify for some Medicaid coverage. All 4 levels receive Extra Help for their prescription drugs.

- QDWI—Qualified Disabled & Working Individual – This is also a level of Medicaid qualification. Individuals are eligible for Medicaid payments of the Medicare Part A premiums only. They are not otherwise eligible for Medicaid.

- QI—Qualifying Individual – This is a level of Medicaid qualification. Medicaid pays their Medicare Part B premiums only. They are not otherwise eligible for Medicaid benefits. BTW, this is often pronounced “quimby.”

- QMB (only)—Qualified Medicare Beneficiary – This is a level of Medicaid qualification. Medicaid pays their Medicare Part A and B premiums, deductibles, coinsurance, and copayment amounts only. They receive Medicaid coverage of Medicare cost-share but are not otherwise eligible for full Medicaid benefits.

- SLMB (only)—Specified Low-Income Medicare Beneficiary – Medicaid pays their Medicare Part B premiums only. They are not eligible for other Medicaid benefits. BTW, this is often pronounced “slimby.”

See Dual Eligibles.

- MSSP

- Medicare Shared Savings Program—The MSSP, according to the Center for Medicare and Medicaid Services (CMS), aims to encourage coordination and cooperation among providers to improve the quality of care for Medicare Fee-For-Service (FFS) beneficiaries and reduce unnecessary costs. The MSSP is a model of the Accountable Care Organizations (ACO) and can be considered an alternative payment model (APM) (both terms are briefly defined herein).

- MTM

- Medication Therapy Management—This is medical care provided by pharmacists whose aim is to optimize drug therapy and improve therapeutic outcomes for patients, especially for individuals with chronic conditions. Eleven national pharmacy organizations adopted this definition in 2004. Medication therapy management includes a broad range of professional activities, including but not limited to performing patient assessment and/or a comprehensive medication review, formulating a medication treatment plan, monitoring efficacy and safety of medication therapy, enhancing medication adherence through patient empowerment and education, and documenting and communicating MTM services to prescribers in order to maintain comprehensive patient care. Medication therapy management includes five core components: a medication therapy review (MTR), personal medication record (PMR), medication-related action plan (MAP), intervention and/or referral, and documentation and follow-up. Under Medicare, patients qualify for MTM by having multiple chronic conditions, taking multiple medications, passing a threshold in medication costs.

- NAIC

- National Association of Insurance Commissioners—The NAIC is the U.S. standard-setting and regulatory support organization created and governed by the chief insurance regulators from the 50 states, the District of Columbia and five U.S. territories. Through the NAIC, state insurance regulators establish standards and best practices, conduct peer review, and coordinate their regulatory oversight. NAIC staff supports these efforts and represents the collective views of state regulators domestically and internationally. NAIC members, together with the central resources of the NAIC, form the national system of state-based insurance regulation in the U.S. The NAIC is an Internal Revenue Code Section 501(c)(3) non-profit organization.

- NPN

- National Producer Number—This is a unique number assigned to producers, agencies, adjusters, and others that are engaged in the insurance business.

- OASDI

- Old-Age, Survivors, and Disability Insurance—This is the particular program that most people think of when the hear the term Social Security; however, it is just one of several social welfare and social insurance programs.

- OEP

- See Election Periods

- OEPNEW

- See Election Periods

- OEPI

- See Election Periods.

- OIG (HHS)

- The Office of the Inspector General for the U.S. Department of Health and Human Services (HHS) is charged with identifying and combating waste, fraud, and abuse in the HHS’s more than 300 programs, including Medicare and programs conducted by agencies within HHS, such as the Food and Drug Administration, the Centers for Disease Control and Prevention, and the National Institutes of Health.

- OOP

- Out Of Pocket costs—This are costs that an insurance beneficiary pays for out of his or her own pocket, costs like deductibles, co-payments, coinsurance, and so forth. Both MA and PDP plans have maximum out-of-pocket limits set annually. Once the MOOP in a MA or MAPD plan is reached, then the plan pays 100% of the medical. Once the MOOP of a PDP plan is reached, then catastrophic coverage begins.

- Optional Supplemental Benefits

- See Extra Benefits.

- OSB

- Optional Supplemental Benefit—These are riders on MA/MAPD plans. They usually offer comprehensive dental or vision or hearing benefits.

- Part A coverage (Medicare)

- This aspect of the Medicare Program covers for inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Generally speaking, a person needs to sign up for Medicare Parts A and B; they usually do so at the local Social Security office or by calling the Social Security Administration around 3 months before they turn 65. Also generally speaking, Parts A and B become effective on the first of the month in which a person turns 65. A person qualifies for Part A when he or she or a spouse paid Medicare taxes for 40 quarters. When this has not happened, then a premium for Part A is applied. In 2021, a person who has not paid taxes for 30 quarters has a monthly premium of $471/month. If they paid taxes for 30 – 39 quarters, then the monthly premium is $259. The Part A deductible for each benefit period in 2021 is $1,484.

- Part B coverage (Medicare)

- This aspect of the Medicare Program covers for providers who see patients that do not stay over night, so it covers doctors’ office visits, outpatient care, medical supplies, and preventive services. Generally speaking, a person needs to sign up for Medicare Parts A and B; they usually do so at the local Social Security office or by calling the Social Security Administration around 3 months before they turn 65. Also generally speaking, Parts A and B become effective on the first of the month in which a person turns 65. Part B has both a premium and a deductible. For 2021 the Medicare Part B premium is $148.50. People with high incomes will pay more. The Part B deductible is $203 in 2021. After one pays that, one pays 20%.

- Part B Drugs

- Part-B drugs cannot be covered by Part D. The list of Part-B drugs often includes the following:

- Some antigens

- Some osteoporosis drugs

- Erythropoietin (for ESRD)

- Hemophilia Clotting Factors

- Injectable drugs

- Some oral cancer drugs

- Part-B-covered chemotherapy drugs

- Oral anti-nausea drugs

- Part C coverage (Medicare)

- Medicare Advantage combines the benefits of both Part A and Part B and usually includes Part-D drug coverage. Administered through private insurance companies, out-of-pocket costs incurred by beneficiaries are generally lower than for beneficiaries receiving only original Medicare since they have out-of-pocket maximums, a benefit missing from original Medicare. Several types of plans qualify as Medicare Part C plans, including MAPD’s, MA-Only’s, SNP’s, and MSA’s. If Part D is included, it involves the same phases as a stand-alone Part-D plan. (See below.)

- Part D coverage (Medicare)

- This is prescription-drug coverage sponsored by private insurance companies but overseen by CMS. Part D may be a stand-alone prescription drug plan used with original Medicare or is a component of a complete Medicare health plan (Part C). There are usually four phases to Part D coverage, although the first phase is optional: (1) Deductible phase, (2) Initial-Coverage phase, (3) Coverage Gap (“donut hole”), and (4) Catastrophic Coverage. CMS comes out with new dollar thresholds for each of the phases each year.

- Partial Dual

- Medicaid beneficiaries who do not have full Medicaid coverage and may not be eligible to enroll in D-SNP plans. The qualification categories are: QDWI, QI, SLMB. See Dual Eligibles.

- PBM

- Pharmacy Benefit Manager—Definition coming!

- PBP

- Plan Benefit Package—A set of benefits for a defined MA or PDP service area. The PBP is submitted by PDP sponsors and MA organizations to CMS for benefit analysis, marketing, and beneficiary-communication purposes.

- PCP

- Primary Care Physician—Within a provider network, this is a type of physician who provides both the first contact for a person with an undiagnosed health concern as well as continuing care of varied medical conditions, not limited by cause, organ system, or diagnosis. Formerly, s/he was called a general practitioner. MA-plans, particularly HMO’s and SNP’s, may require a referral from a PCP in order for a patient to see a specialist. If a referral is not obtained, the patient is considered out of network and must make his/her own payments plans.

- PDP

- Prescription Drug Plan—A PDP is a drug plan that is used with original Medicare. Generally, a speaker using the term is referring to a stand-alone Part-D plan, one that can be used with a Medicare Supplement.

- Permission to Contact

- The Permission to Contact is written pre-authorization to contact Medicare beneficiaries. BRC’s are the most common types of permission although this is expected to change as electronic forms of communication become more prevalent. CMS anticipates that agents will save Permissions to Contact alongside the SOA’s and will retain them for the same length of time, 10 years.

- PFFS

- Private Fee For Service—These are Medicare Advantage plans that are granted flexibility regarding the provider networks. See Medicare Coverage Options.

- PHI / PII

- Personal Health Information (PHI) and Personally Identifiable Information (PII) is information about an individual that is protected by law. This is any information about an individual’s health status, health care resources, or payment for health care insurance or services that can be linked to a specific individual. PHI includes names, addresses, phone numbers, email addresses, social security numbers, insurance ID or account information, and much more.

- Plan Sponsor

- This is the CMS’s term for a carrier who goes through the process of having a health plan ratified by CMS, whether the plan be a health plan, a prescription-drug plan, or a combination. The carrier is not the outright owner of the plan since it is very much under the control of the Federal Government. The meaning of the term Plan Sponsor seems to have drifted to include any health insurance carrier that is overseen by a government program or agency. The FDR’s help Sponsors fulfill their contracts with CMS.

- Population Health Management

- Population Health Management is a discipline that endeavors to address rising healthcare costs. ACO’s, HMO’s, and ACA are attempts at population health management. An important population for this glossary is the Medicare population.

- PPO

- Preferred Provider Organization—See Medicare Coverage Options.

- Premium

- See Cost Sharing.

- Preventive Care

- See Medicare Preventive Care in this list.

- Prior Authorization

- See UM.

- Provider

- Providers are individuals or organizations that deliver health and wellness benefits to insurance or Medicare beneficiaries. Examples are hospitals, skilled-nursing facilities, imaging clinics, pharmacies, individual doctors, nurses, and so on.

- QI

- Qualifying Individual—See Dual Eligibles.

- QDWI

- Qualified Disabled and Working Individual—See Dual Eligibles.

- QMB

- Qualified Medicare Beneficiary—See Dual Eligibles.

- QMB+

- Qualified Medicare Beneficiary Plus—See Dual Eligibles.

- Quantity Limits

- See UM.

- Related Entity

- A entity related to a Sponsor by (1) common ownership, by (2) leasing real property to a Sponsor, (3) by selling more than $2,500 during a contract period (1 year), or (4) by performing a management (as opposed to an administrative) function for a plan Sponsor. Examples are health promotion providers and SilverSneakers.

- SAM

- System for Award Management—Software maintained by the General Services Administration (GSA) of the federal government. The database includes information on entities debarred, suspended, proposed for debarment, excluded, or disqualified from receiving Federal contracts or certain subcontracts, financial assistance, or non-financial assistance and benefits.

- SAR

- Service Area Reduction—When a Medicare-Advantage plan pulls its coverage from a certain area, the former beneficiaries receive a right to choose another plan to replace it (SEP). This right allows a beneficiary to change the type of plan and well as the carrier. A beneficiary can elect a MedSupp if that seems wise.

- SEP